MONEY GUIDE: THE TOP 6 MUST KNOW MONEY FACTS TO GROW WEALTH

And why your savings account is losing your money.

The Federal Reserve “printing money” out of thin air devalues U.S. Dollars because that’s what inflation (putting more dollars into the system) does. That includes the U.S. Dollars in your savings account. And it’s not just the Federal Reserve. Any central bank in the world that participates in creating paper money not backed by anything but their word brings down the value of their currency.

Michelle, The Freedom Friend, checking out different banks in Singapore to see if putting your money in their savings accounts isn’t a huge waste of time

What banks give you

I checked out some banks in Singapore to see what one of the richest, most expensive cities in the world was offering in terms of interest rates to its savers. (I actually went into banks in Singapore) Unfortunately, just like the U.S., Singapore, has comedic interest rates for savers. We’re talking .01% on your savings. That’s not 1%. That’s .01%. Point zero one percent! That means if you put $100 in your savings account, compounded monthly, at the end of the year you will have increased your money by one cent. Not to mention the tax you’re supposed to pay on the interest you earn.

Pardon me, I snorted a little when I broke into laughter. Actually, I’m wrong. You will not have increased your money by one cent. You will have actually LOST 5.49% of your savings if you’re in the U.S. To be even more concise, you will have lost 5.49% of your savings’ purchasing power. It’s because of a little thing called ‘inflation’.

Inflation is a silent, invisible thief. It’s nearly impossible to see your money disappearing. The numbers stay the same but their purchasing power declines.

What our government takes from you very, very, very quietly – like a little mouse.

Basically, if you received 0.01% on your money, but consumer prices rose by 5.5% (the inflation rate near the end of 2014), then a year later your purchasing power of your savings will have dived by 5.49% (5.5% minus 0.01%) calculated simply. That inflation rate is according to the shadowstats.com website. I prefer to use this website’s figures because, like the award winning economist, John Williams, who created it, I believe that the quality of government reporting has deteriorated significantly in the last couple of decades.

For example, the Bureau of Labor and Statistics has only recently started excluding food and energy prices in calculating the core CPI. The core CPI is supposed to measure the real cost of living in America. To me, it is illogical, since all Americans use food and energy everyday, to exclude food and energy from the cost of living calculation. By excluding food, energy, housing, etc. (things that we all know have been increasing in price significantly in the last 20 years) the government can claim a lower inflation rate. Organizations, like the Federal Reserve, can easier support their policies with a lower reported inflation rate. But that’s a whole different story I will write about another time. But the shadowstats.com website uses methodologies the government used to use in the 80’s and 90’s to calculate inflation, which includes food and energy.

If you prefer to use the Bureau of Labor and Statistics number, which was 2% near the end of 2014, then you would have LOST 1.99% of your savings’ purchasing power. (2.0% minus 0.01%). Either way you look at it, having a savings account in America, or in most other countries, is depleting the value of your money. The number of dollars in your account, at the end of the year, might have creeped up a tiny bit, but the amount that you can purchase with those dollars went down way more. That is called ‘inflation adjusted’.

This means if you’re putting your dollars into a savings account in America, you are losing money. A CD is no better. If you have over $250,000 that you are willing to not touch for 10 years, the bank will give you 1.05% interest. 1.05% interest!! Hopefully, you would never do that because your $250,000 would lose so much purchasing power over those 10 years earning 1.05% interest. You would need a savings/CD account offering upwards of 6% interest to prevent your cash’s purchasing power from bleeding out. No bank on earth is offering that at the moment.

This is why inflation is a silent, invisible thief. It’s hard to see your money disappearing. The numbers of dollars you own doesn’t change, but what they are worth does. Your dollars’ purchasing power diminishes.

The kind of inflation that causes your groceries and consumer goods to increase in price consistently, year after year, is because of the Fed’s monetary policies.

Inflation and your groceries

If one bag of groceries costs me $30 today, next year with a 5.5% inflation rate, that same bag of groceries will cost me $31.65. The following year it will cost me $33.39. The next year $35.23. The next year $37.17. And so on. The increases seem small per year, which is why many of us don’t notice it right away. But we all know that a bag of groceries today costs significantly more than it did 15 years ago. And when inflation affects everything you buy, not just that one bag of groceries, you have a significant decrease in your lifestyle because you have to pay more for things, which means you can afford less things in your life.

Where do you put your money, then, so it actually grows your wealth?

Good question. I know, it’s disappointing, this whole savings account debacle. You thought you were doing the right thing by saving. All the big financial gurus on TV advise you to save and say nothing about this inflation thing. Bonds are terrible. The tiny return you earn on those are basically like the banks. The stock market is no better. It’s incredibly volatile. It’s either inflated into a decent sized bubble with all the “stimulus” that the Federal Reserve pumps into the system, flooding our economy with cheap money, OR it’s spiraling down because the Fed has pricked it’s bubble with a tiny quarter of a percent interest rate increase. Wait!!! What? Rewind. Do you clearly understand what that last sentence even means?

If your answer is no, or you’re really hazy on it, before you even decide where you need to invest your money, you need to know what your money is, how it works, and how the Federal Reserve is responsible for your savings account losses!

How can you create financial success in a system that you don’t understand?

So before you start randomly putting your money in places that “sound good” and potentially having an epic fail in your investing ventures, maybe the wise thing to do would be to learn the basics of the game you’re trying to play. Yes, the money game. This stuff is not intuitive. You need instructions.

Let’s start our money quest with a little story about dresses and jewelry.

Money and economics affects your ability to afford things you want, like jewelry.

THE STORY ~ Once upon a time, a long, long time ago, the beautiful daughter of the town tailor, Olivia de la Renta, had a talent for designing gorgeous dresses. Money did not exist in this long ago time and so she would barter her beautiful dresses for things she needed or liked. One day, she spotted the most striking ring she’d ever seen for sale by the steel maker’s daughter, Tiffany Diamond. Tiffany was very proficient in jewelry design. Olivia really wanted the ring. She temptingly tried to barter one of her dresses with Tiffany to get it, but Tiffany didn’t want to make the trade with Olivia. Tiffany had enough dresses in her wardrobe. Plus, she didn’t think any of Olivia’s dresses were of equal value to her ring, which was made with precious gems and metals.

As you can see, with a barter system, things can get tricky when trade for things are not always what both parties desire or deem of equal value. In a civilization, one person cannot take care of all their needs and desires by themselves or just by bartering their belongings. In order to get all our needs met, we need to be able to trade or exchange different items or services with each other. These exchanges can happen between individuals, organizations, and even between countries. There are five methods of exchange.

FIVE METHODS OF EXCHANGE

I’m going to quickly discuss the 5 different methods of exchange that people use to get the things they desire:

Bartering is a limited exchange system that only works once in a while. It’s impossible for each person to get all their needs met with barter. A currency exchange is needed.

1st Method of Exchange: PRE-MONEY or BARTER ~ The exchange of one item of value for another item of equal value without using a medium of exchange in the transaction. Tiffany and Olivia’s barter system. For example, a dress for a necklace.

Bartering works. Sometimes. As Tiffany and Olivia have shown, it’s a pretty limited system that can only go so far.

Imagine today if I wanted to barter with John Mackey (CEO of Whole Foods). The trade offer? My super creative, homemade scrapbooks for his delicious organic groceries. Inexplicably, John has no use for my scrapbooks! He denies me the trade! Poo! I’m stuck. No organic food for me!

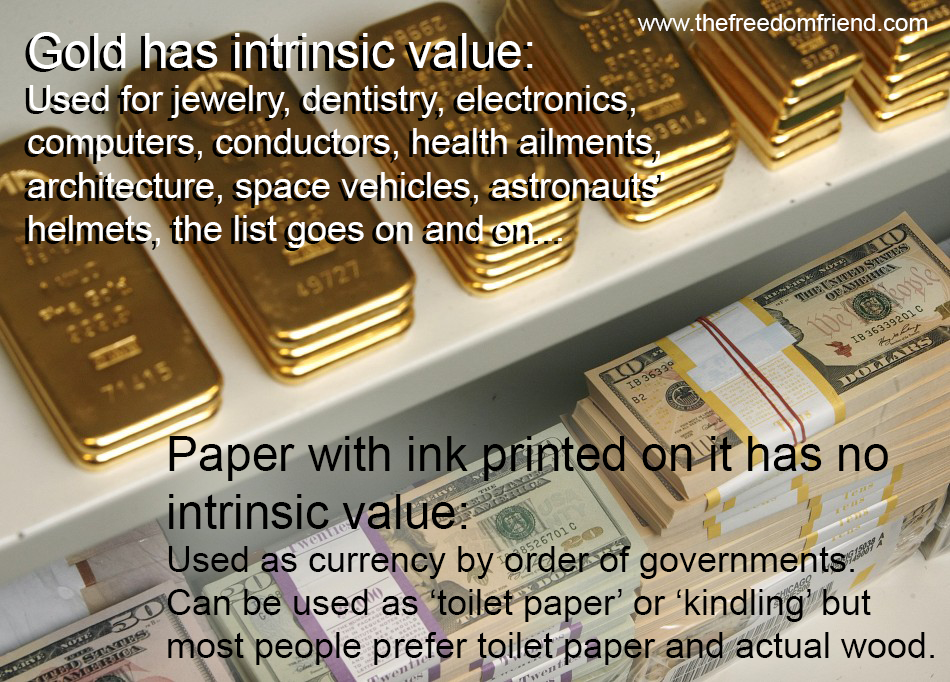

I need, as do you, an established medium of exchange that all parties can find value in. Especially John Mackey! Money is traditionally the best medium of exchange. But I’m not talking about the green ink and paper that Americans call ‘money’. US dollars are currency, they are not money. Wait! I’m getting there. Keep reading.

Paper currencies are backed by nothing of intrinsic value. They are backed by the words of their governments CLAIMING they have value. America’s legal tender laws outlaw the use of real money – gold and silver – and force us to use worthless paper. This amount of paper can buy me lunch.

2nd Method of Exchange: CURRENCY ~ Yes, this is what the U.S. Dollar is. People use currency as a medium of exchange to purchase things that have value. Many currencies contain no innate value, like paper. They only act as a vehicle to transfer value from one asset to another asset, like the U.S. dollar.

The word ‘currency’ comes from the word current – like an electrical current. As currency moves from person to person, it is circulating, like a moving current. If people stop buying things with a particular currency and it no longer circulates from person to person, it is no longer a currency.

Not all currency is “money” either. Throughout time, people have used all sorts of things as currency: paper, salt, grains, shells, unusual stones, beads, spices, livestock…etc. Using salt, grains, or livestock worked well because, if you didn’t want to use your currency to buy something, you could use it for it’s own intrinsic value – you could eat it! All of these items have acted as some kind of medium of exchange in the past but, for various reasons or another, none of them ever successfully passed as money. In order for a currency to make the grade as money, it must fulfill all the characteristics of money.

Only two currencies in history have ever successfully qualified as money – gold and silver. They are hard currencies (not just because they feel hard, in case you were wondering). Hard currencies will not depreciate suddenly or fluctuate greatly in value. At the moment, gold and silver are not circulating as currencies because our government outlawed us from using them as a medium of exchange. We were using gold and silver, and so were other countries, up until 1971. Then President Nixon closed the gold window and the U.S. dollar was no longer backed by gold. But that’s a whole different story!

Gold and silver are sound money – the only currencies that are actually MONEY. They have intrinsic value. More cannot be created by governments to overspend. Which is a great thing!

If you have ever heard about the logic and strength of sound money, that refers to a system when currency and money are one and the same. Put simply, sound money is when the currency is gold and silver or it’s backed by gold and silver. The American dollar used to be money, as was defined by the coinage act of 1792. The dollar was a coin containing 412.5 grains of standard silver, or 371.25 grains of pure silver.

Many of us have grown up thinking that the green and white pieces of paper with George Washington and Abraham Lincoln’s pictures on them are real dollars (or real money). If you lived before 1971, they partially were. But for anyone born after 1971, U.S. dollars are not money. They are pieces of paper backed by nothing. How are we able to buy iPads, cars, clothes, makeup, and food with paper backed by nothing, you ask? Because it is fiat currency and our government forces us to use it with their legal tender laws.

Fiat currency is currency that obtains its value by order of a government decree. The authorities tell us we have to use their paper as legal tender or you go to jail.

3rd Method of Exchange: FIAT CURRENCY ~ Fiat currency is a currency, usually paper, that obtains its value, not by being backed by gold or silver, but by order of a government decree. We are told by the authorities (in our case, the Federal Reserve and the government) that dollars are worth something, when in fact, they do not represent anything of value.

“When governments issue fiat money, they always declare it to be legal tender under pain of fine or imprisonment. The only way a government can exchange its worthless paper money for tangible goods and services is to give its citizens no choice.” (Michael Maloney, author of Guide to Investing in Gold and Silver)

I cannot stress enough how much these pieces of paper and ink, that make up the U.S. dollar, are backed by nothing but the word of the Federal Reserve, or as our government likes to refer to it, backed by “the good faith and credit of the United States.” Sounds official, right?

Fiat currencies are the reason we experience price inflation year after year.

The cost of our consumer goods have been rising for one hundred years thanks to the Fed’s inflation. The last 40 years have seen astronomical increases. Before the Fed existed, America had low, stable prices and people could buy more with their money and have a better standard of living.

Understanding the real differences between money and fiat currencies will help you have a greater understanding on why the prices for our gas, milk, food, jeans, shoes, toys, and other consumer goods increase year after year. Have you ever contemplated the logic behind having the exact same item in a society, with the exact same value, continuously rising in cost? Milk is milk. A dress is a dress. A hamburger is a hamburger. Each item has the same value for a person today as it had for a person sixty years ago – we use milk for the same reasons, wear dresses for the same reasons and eat hamburgers for the same reasons, so why wouldn’t the prices for these items remain the same? The prices keep rising year after year even though the value stays relatively the same.

In some instances, prices can be affected by fluctuations in supply and demand, but those are infrequent and would not explain year after year of steady growth. No. The price inflation (increases) countries have experienced in the last 50 years, and today, has been caused by central banks (the Federal Reserve in the U.S.). Central banks inflate the fiat currency supply in their countries. Essentially printing more currency and putting it into their economies. That drives the cost of goods up. More currency chasing the same amount of goods causes prices to rise.

We have foolishly accepted price increases in our lives over the years. People all over America accept it as fact, like a force of nature that we just can’t control. But there is a good reason behind this phenomenon and it’s not because of nature. You’re not going to like it. The price inflation we’ve had in America over the last one hundred years is man-made. Government-made.

Credit cards are the opposite of money. For something to be money, it must STORE value and be a MEASURE of value. Credit cards do neither.

4th Method of Exchange: MONEY ~ What is money, then? It’s not the U.S. dollar. It most definitely is not that shiny, pretty, platinum, plastic card in your wallet that goes by the name of Visa. Credit cards are actually the complete opposite of money, they are debt (and unless you know how to leverage debt for investments, they are just plain evil)

In order for something to be money it must be a medium of exchange that fulfills two vital functions: it needs to STORE value and be a MEASURE of value. I’m just going to repeat that. Whatever item functions as money needs to be a STORE of value and be a MEASURE of value.

For example, gold itself contains intrinsic value (the very thing itself has value) – so it stores value. Even if we didn’t use it as a medium of exchange, gold would still have its own value and can be used for many other things. Dollars can’t. If we stopped using dollars as a currency, the only thing they’d be good for is kindling for a fire. That is exactly what Germany used their currency for during their hyper-inflationary period.

For something to be money, it must be a store of value and a measure of value. Which of these two do you think fits the bill? Ha! Bill. Get it? *Hint* It’s not the bills.

Compare gold to a $20 bill in your wallet. Go ahead, pull that $20 out. Does the paper and ink that make up the bill in your hand, inherently have any value beyond a few cents? Nope. Does that paper and ink cost $20? Of course not. What if you were holding a $100 bill in your hand? Is that paper and ink worth that purchasing power? No! Not even close. American dollars are fiat currency, not money. U.S. dollars do not store value.

Let’s revisit Olivia and Tiffany and their barter situation. Let’s say Olivia and Tiffany did successfully make a trade. Tiffany priced her ring to be worth two of Olivia’s dresses. This is a barter – an exchange of items that have intrinsic value within themselves and are directly exchanged for their intrinsic values.

The exchange is not monetary because both items are valued for themselves rather than held as a medium of exchange that can be used to buy something else later. Pardon!? Right. Let me explain.

Tiffany didn’t take the two dresses in hopes of saving up more dresses to buy a cart and buggy in the future. She traded her ring for the two dresses to wear the dresses. She wanted the value of the items (the dresses) themselves. The dresses don’t represent any other value besides being dresses. Whereas, gold represents its own value as well as being able to measure the value of other things.

But dresses have intrinsic value so couldn’t they act as money? Besides not fitting in your wallet very well, there are a number of good reasons that dresses, and things like it, do not function well as money. Check out the characteristics of money below and you’ll see why dresses don’t make the grade.

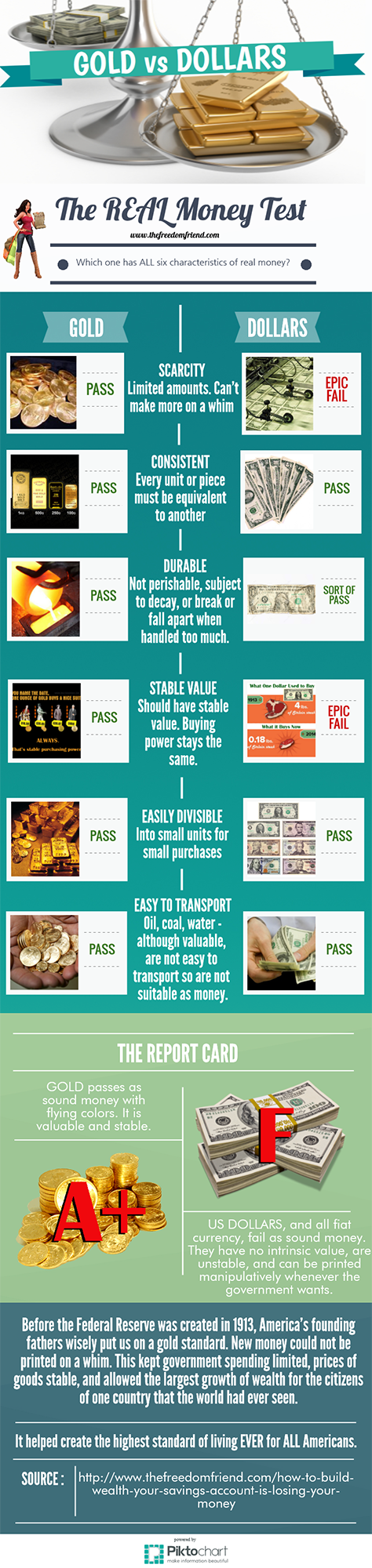

THE 6 CHARACTERISTICS OF REAL MONEY THAT GIVES YOU REAL WEALTH

In order to perform the functions of storing and measuring value, whatever item is acting as money, it needs to have ALL of the following characteristics. Let’s face off the U.S. dollar against gold and see how it fares in this ‘real money’ test.

If you like this infographic and found it helpful in understanding money, please share it with your friends and family!

Epic. Fail. That’s how the U.S. Dollar fares against Gold. Sure, it passed some of the characteristics of money, but that’s not enough to pass as sound money. And it didn’t even pass the most important ones. The important characteristics being that it has value, stability, and governments can’t have the power to print more, hence transferring the wealth of the citizens into the hands of the government through inflation. Sly.

You can use real money in various ways.

1. Commodity Money: Actual commodities like gold, silver, oil, sugar, salt, cows, spices…used as a medium of exchange. For example, using gold to buy a dress.

2. Receipt Money: Paper certificate that is fully backed by real money in a vault somewhere, like gold. It is exchangeable for that gold upon delivery of the receipt. That receipt could also be transferred to another person and they could redeem it for the gold. So you could use the receipt to buy a dress without having to go get the gold. Before the Federal Reserve, the U.S. dollar used to be receipt money which is what made it so valuable.

5th Method of Exchange: FRACTIONAL MONEY ~ A combination of receipt money and fiat currency. It is paper that can be redeemed for real money, like gold. But it is only fractionally backed so if everyone tried to exchange their paper for gold at the same time, there would be a shortage of gold because there would be more paper than gold in the system.

The Sad Dismal Downfall of the U.S. Dollar

The U.S. dollar journeyed from originally being commodity money (actual gold and silver) >> to becoming receipt money (paper currency fully backed by gold and silver) >> to becoming fractional money (paper currency partially backed by gold) when the Federal Reserve was created >> to becoming worthless fiat currency (paper backed by nothing) when the late President Nixon took us off the gold standard. What a downward spiral! From being incredibly valuable to worth practically nothing. This has had a massive effect on our economy and your ability to save and invest. Do you think these huge asset bubbles booming and busting over the last 5 decades are just a fluke?

Back to your savings and why you’re losing money.

Now that you have a better understanding of how money works and what the U.S. dollar actually is, you can better understand how inflation works.

SAVE!! When products in a society are relatively priced by the amount of gold and silver that exists in the world, there are no surprises. Prices for things will generally stay level, unchanging, and predictable.

Saving your money only works when your “money” is valuable, stable money and not fiat currency.

The amount of gold and silver in the world is finite. We can’t just make more of it. That is what keeps it valuable and gets us excited when our husbands or boyfriends buy it for us in the form of presents! When all things in a society are relatively priced by the amount of gold and silver that exists in the world, there are no surprises. Prices for things will generally stay level, unchanging, and predictable. Saving makes sense in that environment.

Fiat currency silently steals your wealth through inflating the ‘money’ supply and devaluing the dollar. Endless amounts can be printed, as long as there are trees.

On the other hand, when dollars are not constant, when they are just numbers in a computer or printed pieces of paper not backed by gold, infinite amounts of dollars can be created. They are not valuable. Our government and banking system continuously create too many new dollars not backed by anything. They do it by having the Fed “buy” treasury bonds with nothing but air and also when banks practice fractional reserve banking. This has been the cause for so much instability in our economy for decades now.

Prices for products we buy constantly rise because the amount of currency in the system keeps increasing. If the dollar had kept the value it had in 1965, then milk should only cost us ten cents today. Saving fiat currency does not make sense in an inflationary environment because the dollars in your account are losing purchasing power by the day and buying less and less. Your best bet is to find an investment for your currency that beats the inflation rate.

The Fed’s chairwoman, Janet Yellen, is very publicly doing everything she can to stoke America’s inflation to 2% every year. With the savings account rate at 0.01%, you are guaranteed to LOSE 1.99% per year. It’s a joke.

Fortunately, there are ‘safer’ havens you can put your currency into and it’s not the stock market, bonds, and definitely not banks.

Break free from the herd mentality idiocy and invest in vehicles that have sound economic sense. The vast majority of the investing crowd will not be prepared for the coming financial crisis. This coming ‘currency’ bubble crash will make the ‘real estate’ bubble crash of 2008 look like a guppy compared to the whale that is coming.

Millions of people will get their savings, retirement, and investments wiped out.

Will you be prepared?

Did you like this post? If so, subscribe for our updates and we will send you more like it. Please share it with your friends and loved ones!

Want more helpful information? I have a compelling video that you’ll find very interesting. Click the button below to view it.

Disclaimer: All products, services, and content by our company, or on our website, are for educational and informational purposes only. Making decisions based on any information presented in our training, products, events, services, or web site, should be done only with the knowledge that you could experience risk or losses just like any entrepreneurial endeavor. Use caution and always consult your accountant, lawyer or professional adviser before acting on this or any information related to a lifestyle change or your business or finances. You alone are responsible and accountable for your decisions, actions and results in life, and you agree not to attempt to hold us liable for your decisions, actions or results, at any time, under any circumstance.