High taxes, tariffs, artificially low interest rates, and the Reserve Bank of Australia printing up money is driving the cost of housing and goods in Australia outrageously high. Image credit: McFarlane Photography

I am currently in Sydney, Australia visiting my brother and sister-in-law. The Brit and I are having an amazing time playing with his little niece and visiting the incredible beaches that are here in Sydney. I live in LA and, as much as I love the beaches along the California coast, the beaches in Australia with their little coves and inlets are just breathtaking.

TOO expensive!

What I have a hard time coming to terms with, here in Australia, is the ridiculous cost for everything. Everything is outrageously expensive. Way more than even Europe. Especially housing. Yesterday, the Brit and I had lunch at a sweet, cozy spot with a burning fire in a fireplace in Manly Beach overlooking the ocean. Our server was an American and I immediately started chatting him up about why he was in Australia and his experiences here.

He is a recent grad from Arizona and wanted to take a year or two to live abroad. I asked him if he found it expensive in Sydney and his eyes just lit up and he burst out exclaiming everything was crazy costly. He said he missed his spacious 1,100 sq foot apartment in AZ for $550 per month that was now replaced by a cramped apartment here in Sydney shared with two other people and costing him $400 a week!

That’s to be expected to some degree. Different areas, of course, have different housing prices based on supply and demand. For example, an apartment in New York City will run more expensive on sale prices and rents compared to Arizona because of higher population and less land to build out on. Supply and demand.

But the sky rocketing housing prices in Sydney for the last five years are more than just simple supply and demand principles driving them up. While shopping for their new home last year, my brother and sister-in-law said homes were increasing by $100,000 in just one month! They felt pressured to buy quickly before prices inflated even more.

Inflation (more currency put into the system by banks and the Reserve Bank of Australia), high tariffs imposed by the government, high taxes imposed by the government, artificially low interest rates, are all causing a growing bubble in their economy and pushing prices through the roof.

Sydney’s fast growing housing prices are all too familiar to the U.S’s housing bubble boom in 2005-2007 before it all crashed in 2008.

To give you an idea of the real difference in lifestyle and cost of living, I chose to compare Sydney to the two cities that I reside in – Los Angeles and Denver. These are photos of houses that are around $2 million in each location. I believe that Sydney’s housing bubble still has a ways to go too so you can only imagine how much worse the situation is going to get in Australia before their bubble bursts. These numbers are current as of September 10, 2015.

Sydney House vs. Los Angeles House vs. Denver House

Sydney ~ $2 million USD will buy you an old, unrenovated 3 bedroom, 1 bathroom, 1,800 sq ft house in a nice suburban neighborhood 20 minutes outside central downtown Sydney.

Los Angeles ~ $2 million USD will buy you a newly renovated 5 bedroom, 5 bathroom, 5,200 sq ft in a suburban neighborhood 20 minutes from central LA. Image Credit: Redfin.com

Denver ~ $1.9 million USD will buy you a 6 bedroom, 8 bathroom 10,200 sq ft house in a nice suburban neighborhood 20 minutes from central Denver. Image credit: HighGarden.com

$2 Million Sydney Entryway vs. Los Angeles Entryway vs. Denver Entryway

Walking into your $2M home in Sydney. Image credit: Realestate.com.au

Walking into your $2M home in Los Angeles

Walking into your $2M home in Denver

Sydney Kitchen vs. Los Angeles Kitchen vs. Denver Kitchen

Cooking dinner in your $2M Sydney kitchen

Cooking dinner in your $2M LA kitchen

Cooking dinner in your $2M Denver kitchen

Sydney backyard vs. Los Angeles backyard vs. Denver backyard

The $2M Sydney yard where your kids can play

The $2M LA yard where your kids can play

The $2M Denver yard where your kids can play

Australia’s prices are too high.

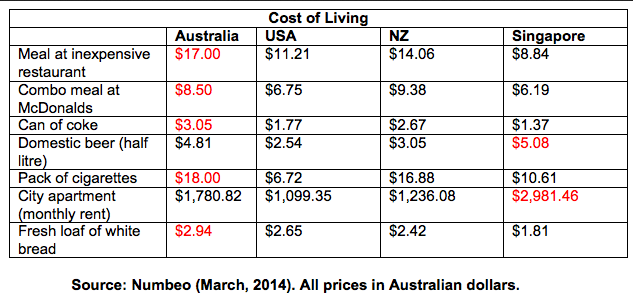

According to Numbeo, a global database on living conditions where users contribute data from around the world, the cost of renting in Australia is 36% higher than the U.S. Grocery prices in the U.S. are 24.85% lower than in Australia. In Singapore they are 18.52% lower, in the UK 12.25% lower, France 9.67% lower and Japan 9.47% lower.

When it comes to food prices, news.com.au’s analysis of the EIU’s data found that Sydney was more expensive than London, New York and Hong Kong if you calculated the price of a basket of food including bread, butter, apples, tomatoes, eggs, mince, fresh chicken, cheese, spaghetti and milk.

The Sydney Morning Herald stated that “Sydney, along with Paris and London, was ranked as one of the most expensive places in the world for a weekend getaway, mainly due to high hotel room prices. A Sydney five-star hotel room is more than twice the price of one in New York.

“Australian consumers pay an average of 52 per cent more for iTunes music, 50 per cent more for PC games, 41 per cent more for computer hardware, and 34 per cent more for software compared with consumers in the USA, according to CHOICE research.” (thenewdaily.com.au)

High prices for consumers is what happens when governments interfere in markets

There are a number of reasons that product and housing prices in Australia are so high. Most of them have to do with the government’s interference.

- Australia’s government charges high taxes on certain products. 70% of every pack of cigarettes goes to the government. 51% of fuel goes to the government. Whether you agree with smoking or not, the consumer could have kept that 70% (which is their hard earned money) and spent it on more cigarettes or food or rent or savings (which would have helped grow the economy). Instead, it is now sitting in some bureaucrat’s pocket. Any time government decides it wants a chunk of the profits, it always drives the price of that product higher for the consumer.

- There is hardly any competition for supermarkets in Australia. Coles and Woolworths dominate the market. Without free market competition keeping companies honest and giving the best deal to consumers to beat each other out, the supermarkets in Australia enjoy much higher profit margins than other supermarkets around the world. “Jean-Yves Heude, the former chief executive officer of Kelloggs ANZ, estimates that shoppers are probably paying about 3-3.5 per cent more for groceries due to the dominance of the two main supermarkets in Australia.” (news.com.au) He went on to say that “Woolworths’s earnings before interest and taxes is 7.6 per cent and this is one of the highest in the supermarket world…the average for retailers across the world was 3-4 per cent.” (news.com.au)

- In the absence of market competition, some have suggested the government step in to control price inflation. Nothing hurts an economy more than when a government starts interfering with the free market signals of what prices should be and bureaucrats try to price products the way they “believe” they should be. Humans do not have the ability to determine the right prices for things. The millions and millions of consumer choices and behaviors are what determines market prices and they would be best left to that. What Australia needs is more competition. More stores. More choice for its consumers.

- Australia’s government imposes extreme regulations on products making it hard for other countries to export their goods to Australia. This prevents Australians from being able to enjoy cheaper products from competing companies abroad. Some say this is good because then Australians are buying from other Australians and keeping Australians employed. In actuality, this prevents Australians from having choice and the ability to purchase more affordable products while making Australia uncompetitive in the global market and unable to sell a lot of products beyond its borders.

- Geo-blocking is the reason Australians overpay for technology and online entertainment. Geo-blocking is a government policy that restricts Australians’ access to content based on geographic location. The head of media at consumer group, Choice, Tom Godfrey, said that this means Australians usually pay a substantial markup for products and downloadable content from companies like Apple, Microsoft, and Amazon.

- The minimum wage in Australia is one of the highest in the world. It is currently $17.29/hour. For many this may sound like a good idea, but most people don’t realize that a minimum wage not only prices lower skilled workers out of the labor force (the very people it’s supposed to help), but it forces retailers to charge more on their products to make up for the higher labor costs. Low skilled workers get priced out because they don’t have the skills that bring in enough revenue with their work for employers to justify paying them over $17 per hour. We all understand that certain skills are of higher economic value than others. Australia’s companies were able to absorb this high minimum wage during their commodity boom of the last 10 years because they had excess cash. They were overpaying for labor and didn’t worry about inefficiencies. However, if they didn’t have a minimum wage, Australia’s economy would have grown even stronger and more people would have been employed in jobs appropriate to their skill levels. But now that their economy is slowing down and unemployment is rising, the cracks of the ineffectiveness of minimum wage are beginning to show. Minimum wage leads to retailers having to charge consumers more to make up for having to overpay in labor costs. This essentially makes those who earn minimum wage no better off since now they have to pay higher prices for their goods.

- Australia has very high income taxes, 45% being the top individual income tax rate. That is just more money out of citizens’ pockets that could be spent on goods, services, homes, savings, investments, etc…all things that better the economy and the lives of Australians. Instead, they go to pay bureaucrats who don’t make anything, who don’t produce anything that grows the economy, and only a fraction of income taxes goes towards government programs that are promised to the people after most of it has gone to government employees.

- Cheap money (money borrowed at low interest rates) encourages people to go into debt to buy property and assets. This artificially drives the cost of housing up.

- Foreign investors are overpaying for properties which drives the prices for real estate up as well. Even though Australia has a law stating that foreigners can only purchase new builds and not existing homes, this has still been keeping the market hot.

- Australian banks lock in Australians with terrible mortgages. Australians get saddled with variable interest rate mortgages and can’t lock in fixed rates for more than 5 years. They are not allowed to refinance without paying “break fees” which eliminates any savings they may have gotten by switching to a lower interest rate mortgage.

The United States is the cheapest of the developed nations.

But not for long. Our government continues to grow and is beginning to look like the high taxing, regulatory government of Australia. Our Federal Reserve and government has definitely made some mistakes that Australia’s government didn’t make. These mistakes led to our housing crash, tech bubble crash, and savings and loan crash.

But Australia is making other mistakes that clearly costs Australians a butt-load. And Americans can expect that same kind of expensive environment if we keep continuing to vote for bigger government, more government programs, and more taxes and regulations. We are already in much more debt than the Australians. Our debtors just haven’t called in our debts yet.

If you like this post or got any benefit out of it, please Share it, Like it, and like a teenager’s note, Pass it Around!

And that’s in Los Angeles and Denver, look what you can buy at the same price in Atlanta:

https://www.zillow.com/homedetails/305-The-Cliffs-Sandy-Springs-GA-30350/2102290810_zpid/

Wondrful article BTW. The homes in the US really are cheap when compared to other developed nations. I am from Israel, housing here is extremely expensive and that’s becoming more and more frustrating. Americans who move to Israel are struggling to buy a house here and usally considering to move back because of the realtive easiness of buying a house in the US.